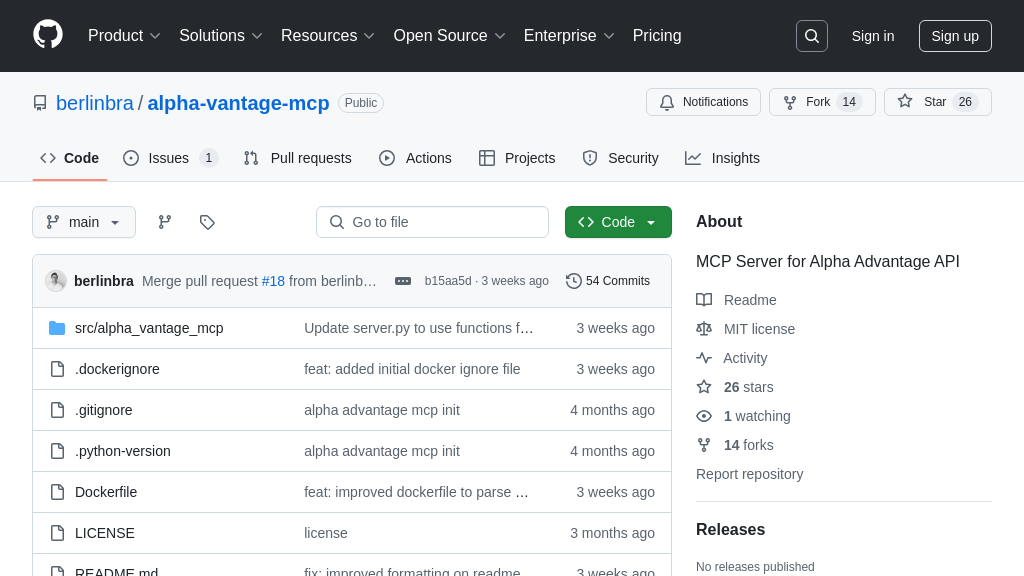

alpha-vantage-mcp

Alpha Vantage MCP Server: Real-time financial data for AI models via MCP.

alpha-vantage-mcp Solution Overview

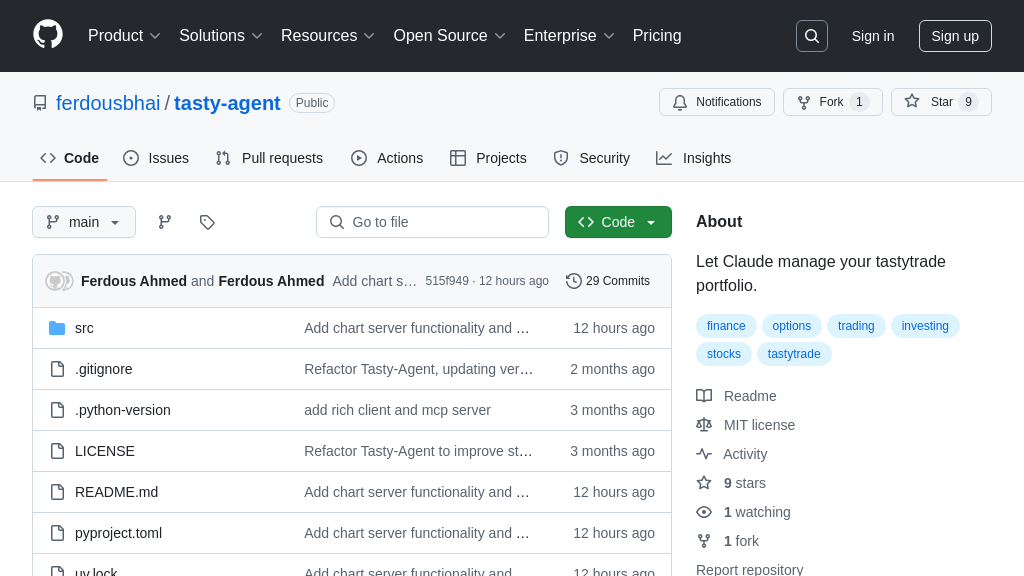

Alpha Vantage MCP Server is a valuable tool for developers seeking real-time financial market data within the MCP ecosystem. As an MCP server, it provides a standardized interface to access stock quotes, company information, cryptocurrency exchange rates, and historical options data via the Alpha Vantage API.

This server empowers AI models with up-to-date financial insights, enabling applications like algorithmic trading, portfolio analysis, and financial forecasting. It addresses the developer's need for reliable and easily accessible financial data, abstracting away the complexities of direct API integration. Key features include real-time data feeds, built-in error handling, and rate limit management.

The server seamlessly integrates with AI models through the MCP client-server architecture, utilizing standard input/output or HTTP/SSE for data transmission. By providing structured financial data, Alpha Vantage MCP Server enhances the accuracy and relevance of AI-driven financial applications. Installation is streamlined via Docker or Smithery, making it easy to deploy and use.

alpha-vantage-mcp Key Capabilities

Real-Time Stock Quotes

The get-stock-quote tool provides AI models with up-to-the-minute stock prices, change, volume, and high/low values for a specified company. This functionality is crucial for AI applications requiring real-time market awareness, such as algorithmic trading, portfolio management, and financial analysis. The tool leverages the Alpha Vantage API to fetch the latest quote data, ensuring that the AI model operates with current information. For example, an AI-powered trading bot can use this tool to make informed decisions based on the most recent price fluctuations. The tool accepts a stock symbol as input and returns a formatted string containing the key metrics. This allows developers to easily integrate real-time stock data into their AI-driven financial applications. The underlying implementation uses httpx to make asynchronous requests to the Alpha Vantage API, efficiently handling data retrieval and formatting.

Detailed Company Information

The get-company-info tool delivers comprehensive details about a company, including its sector, industry, market capitalization, and a brief description. This information is invaluable for AI models performing tasks such as stock screening, investment analysis, and risk assessment. By understanding a company's fundamental characteristics, AI models can make more informed and nuanced decisions. For instance, an AI-powered investment advisor can use this tool to assess a company's suitability for a client's portfolio based on their risk tolerance and investment goals. The tool takes a stock symbol as input and returns a structured response containing the company's key attributes. This enables developers to easily incorporate fundamental company data into their AI applications. The tool uses the Alpha Vantage API to retrieve company overview data, providing a standardized and reliable source of information.

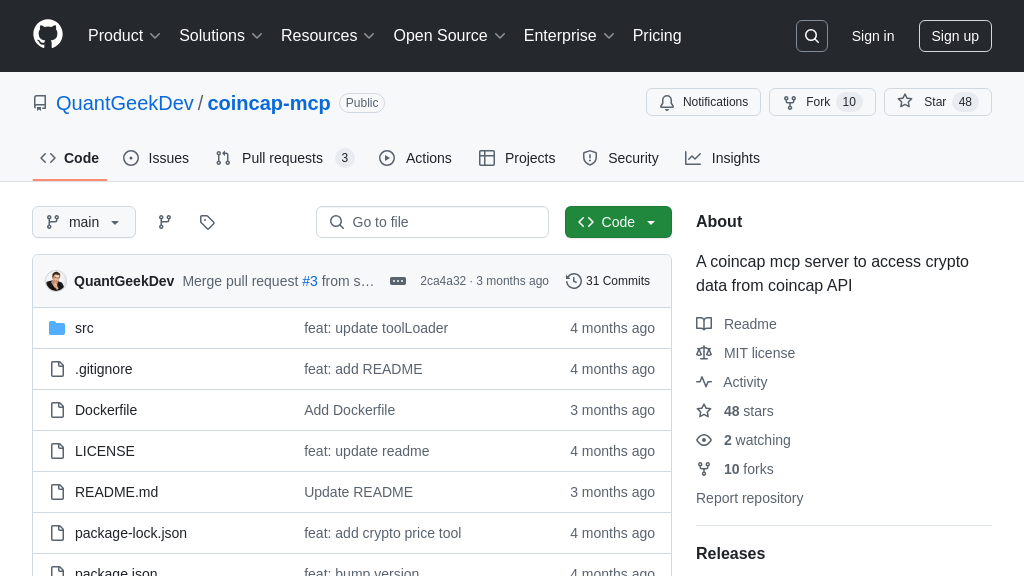

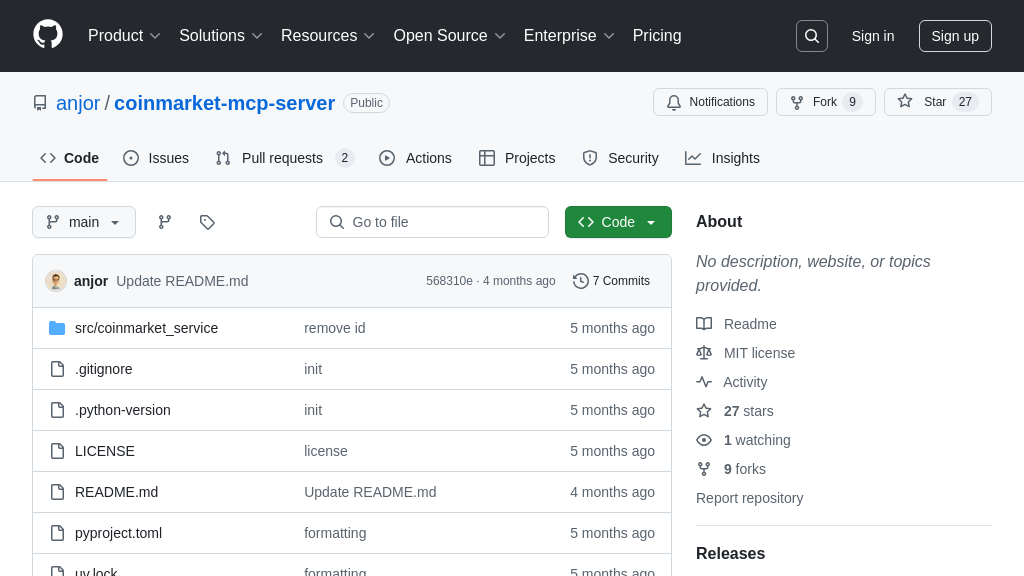

Cryptocurrency Exchange Rates

The get-crypto-exchange-rate tool provides real-time exchange rates between cryptocurrencies and fiat currencies. This is essential for AI models involved in cryptocurrency trading, portfolio tracking, and financial analysis. The tool provides the exchange rate, bid price, and ask price. For example, an AI-powered crypto trading bot can use this tool to monitor price movements and execute trades based on predefined strategies. The tool accepts cryptocurrency and market currency symbols as input and returns a formatted string containing the exchange rate and related data. This allows developers to easily integrate real-time crypto market data into their AI-driven applications. The tool leverages the Alpha Vantage API to fetch the latest exchange rate data, ensuring that the AI model operates with current information.

Historical Options Chain Data

The get-historical-options tool retrieves historical options chain data, including strike price, expiration date, last price, bid/ask prices, volume, open interest, implied volatility, and Greeks (Delta, Gamma, Theta, Vega, Rho). This tool is invaluable for AI models focused on options trading, risk management, and advanced financial analysis. The tool supports filtering and sorting of options contracts based on various criteria, enabling AI models to focus on the most relevant data. For example, an AI-powered options trading strategy can use this tool to identify mispriced options and execute profitable trades. The tool accepts a stock symbol and optional parameters for date, limit, sort by, and sort order. The underlying implementation uses httpx to make asynchronous requests to the Alpha Vantage API, efficiently handling data retrieval and formatting.

Error Handling and Rate Limit Management

The Alpha Vantage MCP server incorporates robust error handling and rate limit management to ensure reliable operation. It gracefully handles scenarios such as exceeding the Alpha Vantage API rate limit, invalid API keys, network connectivity issues, and malformed responses. When an error occurs, the server returns a clear, human-readable error message to the client, facilitating debugging and troubleshooting. This is crucial for AI models that rely on the server for critical data, as it prevents unexpected crashes and ensures data integrity. The rate limit management feature prevents the server from being overwhelmed by excessive requests, ensuring fair usage of the Alpha Vantage API. This is particularly important in high-frequency trading scenarios where AI models may generate a large number of requests in a short period.