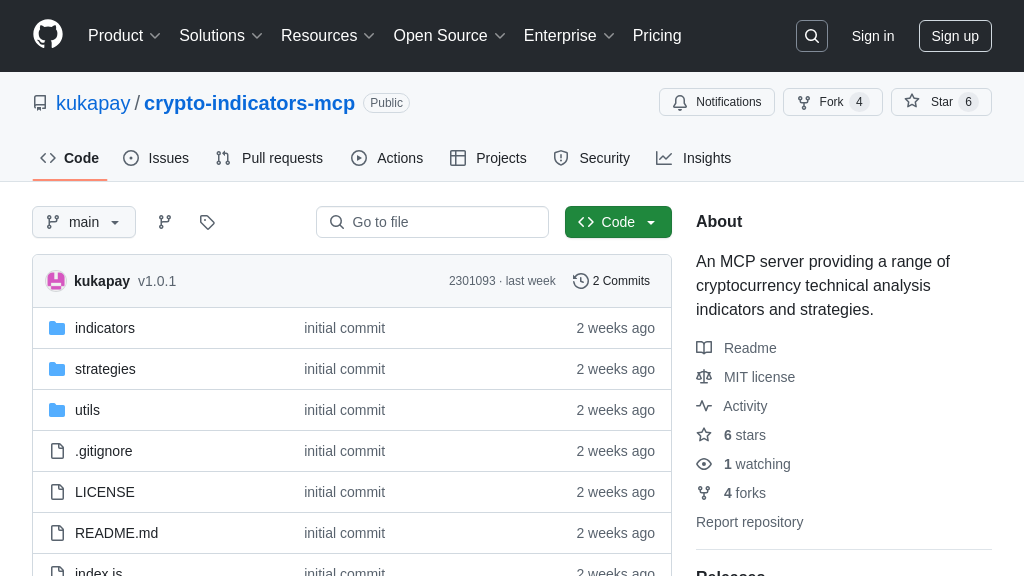

crypto-indicators-mcp

Empower AI trading with crypto-indicators-mcp, an MCP server providing 50+ technical indicators and strategies for crypto analysis.

crypto-indicators-mcp Solution Overview

The Crypto Indicators MCP server is a valuable resource for AI-driven cryptocurrency trading. As an MCP server, it provides AI models with over 50 technical indicators spanning trend, momentum, volatility, and volume, along with corresponding trading strategies that output actionable buy/hold/sell signals. This empowers AI trading agents to efficiently analyze market trends and develop robust quantitative strategies.

Seamlessly integrated via the MCP protocol, this solution allows AI models to request and receive real-time indicator data and strategy signals. Its flexible data source, defaulting to Binance but configurable to any ccxt-supported exchange, ensures adaptability. The modular design simplifies maintenance and customization. By providing pre-calculated indicators and strategies, this MCP server eliminates the need for AI models to implement complex calculations, saving development time and resources, and accelerating the deployment of sophisticated AI trading systems.

crypto-indicators-mcp Key Capabilities

Extensive Technical Indicator Library

The crypto-indicators-mcp server provides access to over 50 technical indicators spanning trend, momentum, volatility, and volume categories. These indicators are essential tools for AI trading agents to analyze market dynamics. Each indicator offers a unique perspective on price action, enabling AI models to identify potential trading opportunities. For example, the Moving Average Convergence Divergence (MACD) indicator helps identify trend direction and momentum, while the Average True Range (ATR) measures market volatility. By combining multiple indicators, AI models can develop a more comprehensive understanding of market conditions and improve the accuracy of their trading decisions. This broad selection allows developers to tailor their AI's analytical capabilities to specific trading strategies and risk profiles.

Strategy Signal Generation

Beyond raw indicator data, the server calculates trading strategies, outputting actionable signals: -1 (SELL), 0 (HOLD), and 1 (BUY). These pre-processed signals significantly reduce the computational burden on AI trading agents, allowing them to react more quickly to market changes. For instance, the RSI strategy generates buy/sell signals based on overbought and oversold conditions, while the MACD strategy uses crossovers to identify potential trend changes. These strategies provide a starting point for AI models, which can then be further refined and customized based on specific trading goals. This feature is particularly valuable for developers who want to quickly deploy AI trading strategies without needing to implement complex signal processing logic from scratch.

Flexible Data Source Configuration

The crypto-indicators-mcp server defaults to Binance as its data source but is configurable to any exchange supported by the CCXT library. This flexibility is crucial for AI trading agents that need to operate across multiple exchanges or access specific market data. By simply modifying the configuration, developers can seamlessly switch between different data sources without altering the core logic of their AI models. This adaptability ensures that the AI trading agent can access the most relevant and reliable data, regardless of the exchange. The use of CCXT also provides a standardized interface for accessing market data, simplifying the integration process and reducing the risk of compatibility issues.

Modular and Maintainable Design

The server's modular design, with indicators and strategies categorized, promotes easy maintenance and extensibility. This architecture allows developers to easily add new indicators or strategies without disrupting existing functionality. The clear separation of concerns also simplifies debugging and testing, ensuring the reliability of the server. This modularity is particularly beneficial for long-term projects that require ongoing updates and improvements. For example, a developer could add a new volatility indicator or customize an existing strategy to better suit their specific trading style. The organized structure of the codebase makes it easier for developers to collaborate and contribute to the project.