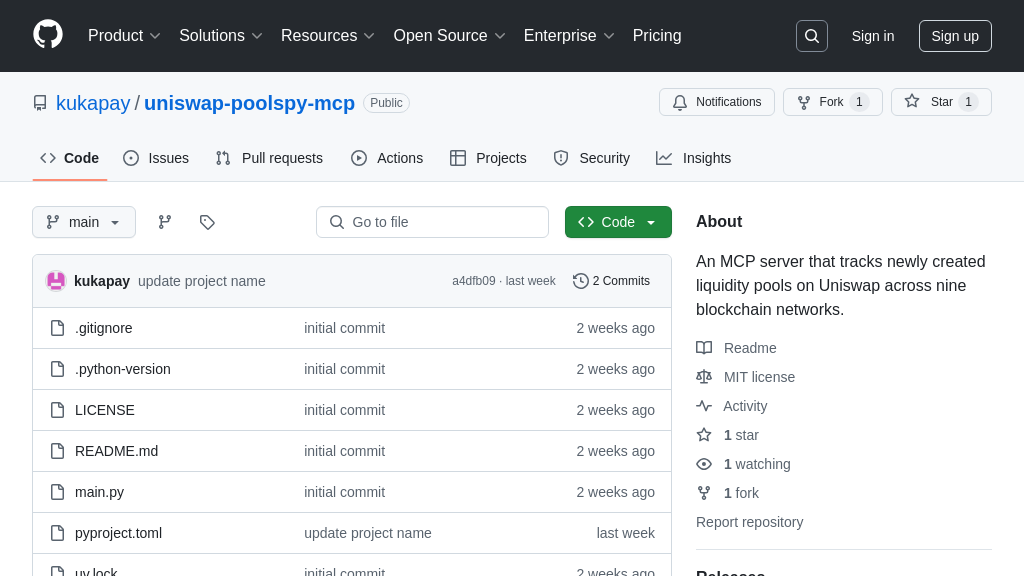

uniswap-poolspy-mcp

Uniswap PoolSpy MCP: Real-time Uniswap V3 pool tracking across 9 chains for DeFi insights.

uniswap-poolspy-mcp Solution Overview

The Uniswap PoolSpy MCP server is a valuable tool for DeFi analysts, traders, and developers, providing real-time tracking of newly created Uniswap V3 liquidity pools across nine major blockchain networks, including Ethereum, Base, and Polygon. This MCP server empowers AI models to access up-to-the-minute data on emerging DeFi opportunities.

Key features include monitoring pool creation, customizable time range queries, and sorting by timestamp, transaction count, volume, or TVL. By integrating this server, AI models can analyze trends, identify promising new pools, and inform trading strategies.

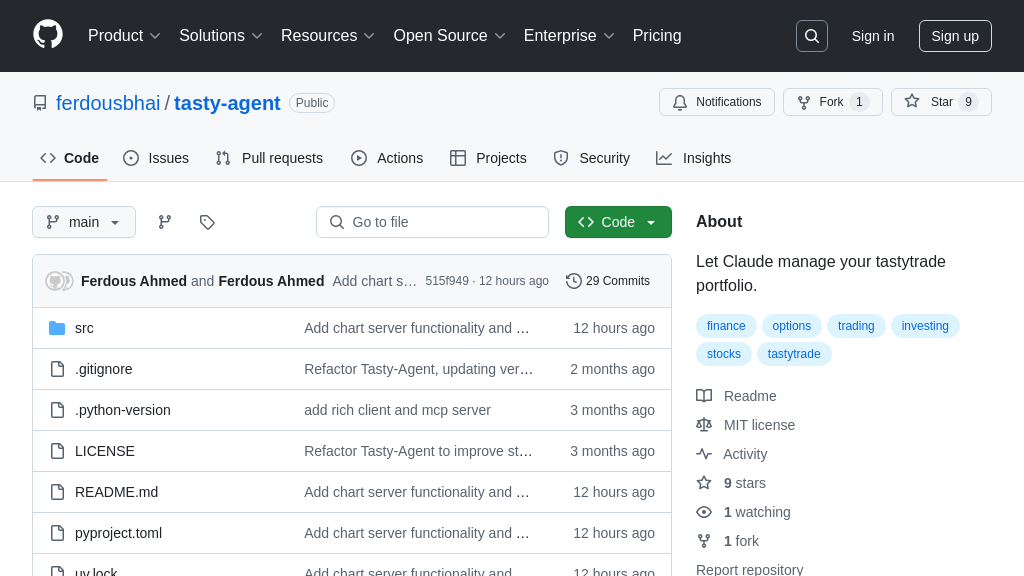

The server seamlessly integrates with MCP-compatible environments like Claude Desktop, allowing users to query new pools using natural language. It utilizes The Graph API to efficiently retrieve blockchain data. This solution delivers critical insights for anyone seeking an edge in the dynamic world of decentralized finance.

uniswap-poolspy-mcp Key Capabilities

Real-time Pool Creation Monitoring

The Uniswap PoolSpy MCP server continuously monitors the creation of new liquidity pools on Uniswap V3 across nine different blockchain networks. This real-time monitoring capability allows AI models to react quickly to emerging market trends and investment opportunities. The server leverages The Graph protocol to efficiently index and query blockchain data, ensuring minimal latency in detecting new pools. This feature is crucial for AI-driven trading bots that need to capitalize on early-stage liquidity pools. For example, an AI model could use this data to identify pools with high initial trading volume, indicating potential for significant price movements. The server's ability to provide immediate notifications of new pool creation enables AI models to make informed decisions and execute trades before the broader market becomes aware. Technically, this is achieved by continuously querying The Graph's API endpoints for Uniswap V3 pool creation events on each supported chain.

Customizable Query Parameters

The server offers customizable query parameters, including time range and result limits, allowing users to tailor their searches for new pools. This flexibility enables AI models to focus on specific timeframes or limit the number of results returned, optimizing data processing and reducing noise. For instance, an AI model focused on high-frequency trading might only be interested in pools created within the last minute, while a longer-term investment strategy might analyze pools created over the past hour. The ability to set result limits prevents the AI model from being overwhelmed with excessive data, ensuring efficient analysis and decision-making. These parameters are exposed as arguments to the get_new_pools tool, allowing users to specify the time_range_seconds and limit values according to their needs. This customization is essential for adapting the server's output to the specific requirements of different AI models and trading strategies.

Multi-Chain Support

The Uniswap PoolSpy MCP server supports nine prominent blockchain networks, including Ethereum, Base, Optimism, Arbitrum, Polygon, BNB Smart Chain (BSC), Avalanche, Celo, and Blast. This broad coverage allows AI models to access a diverse range of liquidity pools across different ecosystems, increasing the potential for identifying profitable trading opportunities. By aggregating data from multiple chains, the server provides a comprehensive view of the decentralized finance (DeFi) landscape, enabling AI models to make more informed decisions. For example, an AI model could compare the performance of similar pools on different chains to identify arbitrage opportunities or assess the overall health of the DeFi market. The server's multi-chain support is implemented by querying The Graph's API endpoints for each supported chain, consolidating the results into a unified data stream. This feature is particularly valuable for AI models that aim to diversify their investments and mitigate risk across multiple blockchain networks.

Sorting and Filtering Capabilities

The server supports sorting by timestamp, transaction count, volume, or TVL (Total Value Locked), enabling AI models to prioritize pools based on specific criteria. This sorting functionality allows AI models to quickly identify the most relevant and promising pools for further analysis. For example, an AI model focused on identifying trending pools might sort by transaction count or volume, while a model focused on long-term investments might prioritize pools with high TVL. The ability to filter pools based on these metrics ensures that AI models can efficiently focus on the most relevant data, improving the accuracy and speed of their decision-making processes. The order_by parameter in the get_new_pools tool allows users to specify the sorting criteria, providing flexibility in how the data is presented to the AI model. This feature is crucial for optimizing the performance of AI-driven trading strategies and investment models.