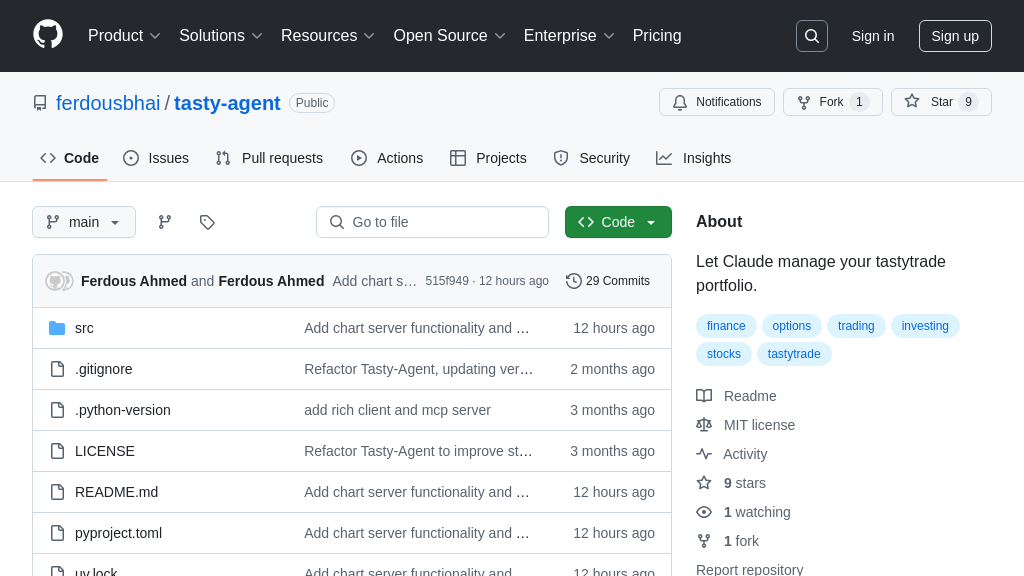

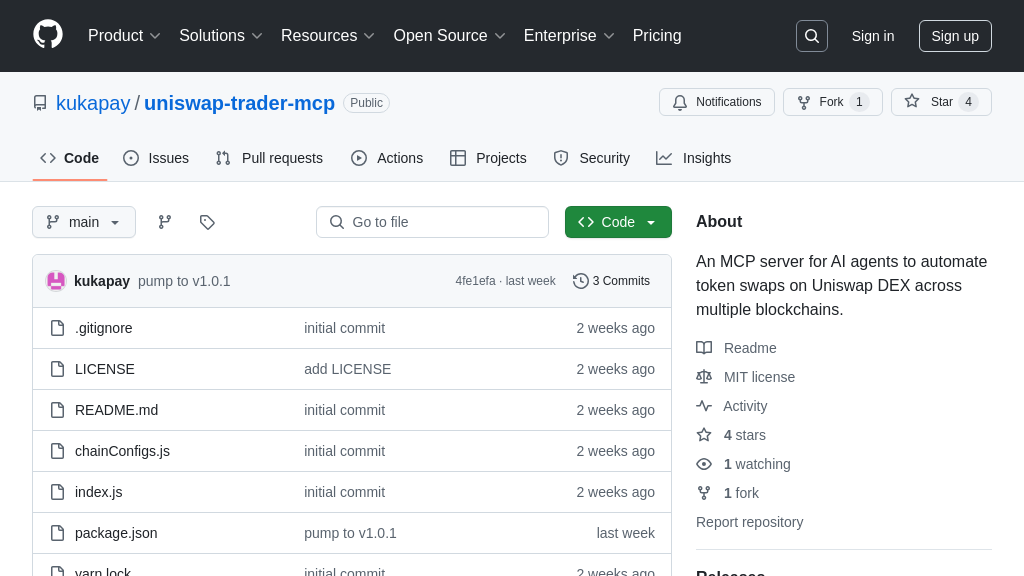

uniswap-trader-mcp

Uniswap Trader MCP: Automates Uniswap token swaps for AI agents across multiple blockchains.

uniswap-trader-mcp Solution Overview

The Uniswap Trader MCP is a server designed to empower AI agents with automated token swapping capabilities on the Uniswap decentralized exchange across multiple blockchains. It enables AI models to programmatically interact with Uniswap, leveraging real-time price quotes, swap execution, and intelligent trading suggestions.

This MCP solution provides key functionalities such as fetching price quotes with multi-hop route optimization and executing swaps on Uniswap V3 with configurable slippage tolerance and deadlines. It also generates trading suggestions based on liquidity, fees, and optimal paths. Supporting blockchains like Ethereum, Optimism, Polygon, and more, it offers broad compatibility.

By integrating with AI models through standardized MCP requests and responses, the Uniswap Trader MCP facilitates the creation of automated trading strategies. Developers benefit from simplified access to Uniswap's liquidity, enabling AI agents to execute complex trades efficiently and securely. This unlocks new possibilities for algorithmic trading and portfolio management within the AI ecosystem.

uniswap-trader-mcp Key Capabilities

Real-Time Price Quotes

The Uniswap Trader MCP provides AI agents with the ability to fetch real-time price quotes for token swaps on Uniswap V3. This feature utilizes multi-hop route optimization to find the best possible swap rates across different liquidity pools. The AI agent can specify the input and output tokens, along with the desired trade type ("exactIn" or "exactOut"), and the MCP server will return a detailed price quote including the estimated gas fees, the route the swap will take, and the minimum amount the agent will receive. This is crucial for AI agents to make informed trading decisions based on current market conditions.

For example, an AI agent could use this feature to determine the optimal time to swap ETH for DAI by continuously monitoring the price quotes and executing the trade when the price reaches a favorable level. The technical implementation involves querying the Uniswap V3 smart contracts through RPC endpoints and calculating the optimal swap route using a graph-based algorithm.

Automated Swap Execution

This core feature enables AI agents to programmatically execute token swaps on Uniswap V3 across multiple supported blockchains. The AI agent can specify the input and output tokens, the amount to swap, slippage tolerance, and a deadline for the transaction. The MCP server then handles the complexities of interacting with the Uniswap V3 smart contracts, including constructing the transaction, signing it with the configured wallet's private key, and broadcasting it to the network. Upon successful execution, the MCP server returns the transaction hash, allowing the AI agent to track the status of the swap.

Consider an AI agent designed to rebalance a portfolio of tokens. It can use this feature to automatically execute the necessary swaps to maintain the desired asset allocation, without requiring manual intervention. The technical implementation involves using a Web3 library to interact with the Uniswap V3 Router contract and handling potential errors such as insufficient liquidity or slippage.

Multi-Chain Compatibility

The Uniswap Trader MCP supports a wide range of Ethereum-compatible blockchains, including Ethereum mainnet, Optimism, Polygon, Arbitrum, Celo, BNB Chain, Avalanche, and Base. This allows AI agents to execute trading strategies across different ecosystems, taking advantage of unique opportunities and arbitrage possibilities. Each chain is configured with its own RPC URL, WETH address, and SwapRouter address, allowing the MCP server to seamlessly interact with Uniswap V3 on each network.

For instance, an AI agent could use this feature to identify and exploit price discrepancies for the same token across different chains, buying the token on the chain where it is cheaper and selling it on the chain where it is more expensive. The technical implementation involves managing multiple Web3 instances, each connected to a different blockchain, and handling the specific nuances of each chain's transaction format and gas pricing mechanism.